maximum loanable amount in sss|Guide on How to Apply for SSS Salary Loan : Manila Learn about the SSS salary loan, a cash loan granted to SSS members based on their contributions. Find out the maximum loanable amount, the requirements, the application process, and the FAQs. Tingnan ang higit pa Only bettors who have registered on the website can access Lotus 365 betting. To validate your account, you have to go through each of the aforementioned processes. There are multiple procedures involved in login lotus365 to placing a wager with the bookmaker. Lotus365 offers Indian users a completely safe and authorized betting environment.Lista de CPU para socket LGA 1155 Aquí hemos enumerado todos los procesadores para socket LGA 1155. Solo los procesadores para un zócalo LGA se pueden intercambiar de forma independiente, ya que solo se conectan a la placa base. En otros zócalos, como los zócalos BGA, los procesadores se sueldan directamente a la placa base y no se pueden .

PH0 · SSS Salary Loan: Requirements and Process Guide

PH1 · SSS Salary Loan: Requirements and Process Guide

PH2 · SSS Salary Loan Loanable Amounts 2024 Based on Member’s

PH3 · SSS Salary Loan 2024: Requirements, Application Process, and More

PH4 · SSS Salary Loan 2024: Requirements, Application Process, and

PH5 · SSS Salary Loan

PH6 · SSS Salary Cash Loan Minimum & Maximum Loanable Amounts

PH7 · SSS Salary Cash Loan Minimum & Maximum Loanable Amounts

PH8 · SSS LOANABLE AMOUNT: How Much Is Loanable Under Salary Loan

PH9 · SSS LOANABLE AMOUNT: How Much Is Loanable

PH10 · Republic of the Philippines Social Security System

PH11 · How To Compute SSS Salary Loan

PH12 · Guide on How to Apply for SSS Salary Loan

25 PE Teacher Interview Questions and Answers. Learn what skills and qualities interviewers are looking for from a PE teacher, what questions you can expect, and how you should go about answering them. Interview Insights. Published Jan 3, 2023.

maximum loanable amount in sss*******Learn about the SSS salary loan, a cash loan granted to SSS members based on their contributions. Find out the maximum loanable amount, the requirements, the application process, and the FAQs. Tingnan ang higit pa

In a nutshell, SSS salary loan is a cash loan that SSS members, whether employed or self-employed/voluntary, can use to meet their short-term needs. Due to the fast approval process and low . Tingnan ang higit pa

To avail of the salary loan, the SSS member must meet the following eligibility requirements: 1. Must be under 65 years oldat the time of application; 2. Must be a regular paying SSS member . Tingnan ang higit pa

Members who have paid 36 monthly contributions are qualified to avail of the one-month salary loan equivalent to the average of the member’s 12 latest posted Monthly Salary Credits (MSCs), rounded to the subsequent higher MSC, or the amount the member applied for, whichever is lower. Since the maximum Monthly Salary . Tingnan ang higit pa

Per the SSS Circular 2019-0142, member-borrowers who want the SSS salary loan must now apply online. To complete the SSS salary loan application, you need the following: 1. Internet connection; 2. My.SSS account. If you haven’t registered and created an account yet, please follow this step-by-step guide; 3. Preferred . Tingnan ang higit pa SSS SALARY CASH LOAN MINIMUM & MAXIMUM – Detailed below is a comprehensive guide on the loanable amounts under the loan offer. Are you qualified to .

LOAN AMOUNT. A one-month salary loan is equivalent to the average of the member-borrower's latest posted 12 Monthly Salary Credits (MSCs), or amount applied for, .The maximum loanable amount for housing loan for repairs and/or improvements is P1,000,000.00, based on appraised value of collateral, borrower's capacity to pay, and .

The maximum loanable amount for direct housing loan facility for OFWs is P2,000,000.00, based on appraised value, capacity to pay, and need. The loan term, interest rate, and . How much can I borrow? And how much is the first loan of SSS? Find the answers to such questions, as well as the eligibility requirements below. ☑️ Up-to-date Monthly SSS Contributions and .

With regards to the SSS Salary Loan loanable amounts this 2024, the borrowing amount allowed by the state-run social insurance giant depends on the .

For the SSS loanable amount under the salary loan offer, here is the explanation of the social insurance institution: A one-month loan is equivalent to the average of member’s last twelve (12) monthly salary .

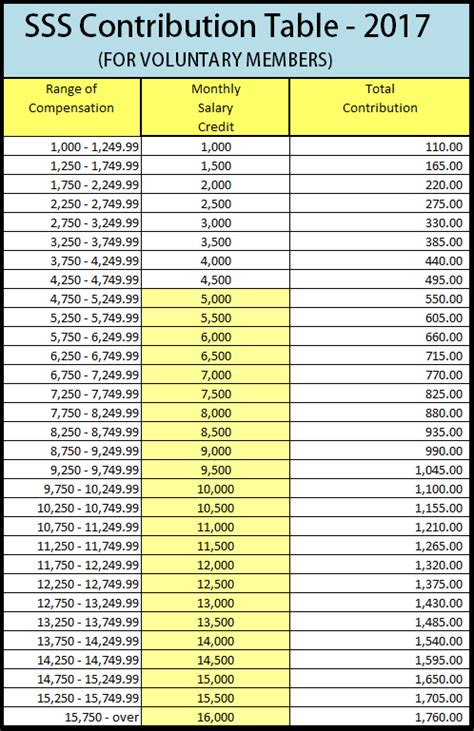

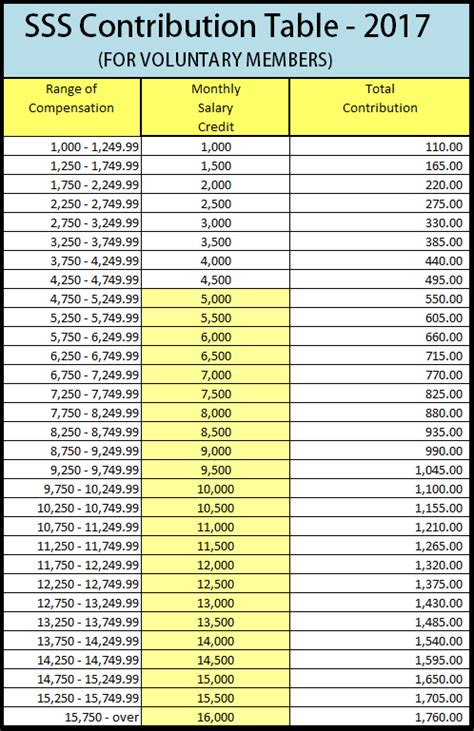

what is the maximum loanable amount in sss salary loan? If the member completed the 36 months of contribution, the member-borrower is subjected to a one .Determining Your Monthly Salary Credit (MSC) The MSC is a key factor in computing your loan amount. It’s determined by your compensation range as provided by the SSS .

Guide on How to Apply for SSS Salary Loan Loanable Amount. The maximum loanable amount is P2,000,000.00. The loan amount granted shall be the lowest amount based on the following factors: . A maximum of three (3) qualified SSS members may be tacked-in for a single loan up to the combined maximum individual availment for the loanable amount secured by the same collateral, .The Social Security System (SSS) disbursed over P115.53 million for educational loans from January to June 2021, 52.5 percent or P39.75 million higher than last year?s releases. . The maximum loanable amount for a degree course is P20,000.00 per semester/trimester/quarter or net tuition/miscellaneous fees/assessment balance on .

1. Open your Internet Browser and type www.sss.gov.ph in your URL. 2. Login using your User Name and Password. If you do not have an SSS Online Account yet, you may create one. Follow this step .For two-month loan: 72 monthly contributions, six (6) of which should have been posted in the last twelve (12) months prior to the month of application. If employed, the member’s employer must be updated in the payment of contributions and loans. The member must also be updated in the payment of other loans with SSS. .

The SSS Online Loan Calculator is a great tool to help you determine how much you can borrow from the Social Security System (SSS). This calculator takes into account your current monthly salary, age, and contribution history to provide you with an estimate of the maximum loanable amount. Simply enter your information into the calculator below .

maximum loanable amount in sss Guide on How to Apply for SSS Salary Loan The member may borrow a one-month or two-month salary loan. Here is a guide on the SSS Salary Loan loanable amounts 2024 based on the total contributions posted by the member-borrower: For members who have posted at least 36 monthly contributions but not more than 71 monthly contributions, the “one-month salary loan is .SSS Building East Avenue, Diliman Quezon City, Philippines. For comments, concerns and inquiries contact: SSS Hotline: 1455 How much is the maximum amount you can borrow from SSS salary loans? That would depend on your salary, of course, and how much your monthly contributions are to SSS. . members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month .All currently employed, currently contributing self-employed or voluntary member. For a one-month loan, the member-borrower must have thirty six (36) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing of application.; For a two-month loan, the member-borrower must have seventy two (72) .

SSS Loan Computation . You can borrow a maximum SSS Salary Loan amount of P15,000 for a one-month loan. The highest amount you can borrow for a two-month salary is P30,000. However, the actual loanable amount will depend on the average amount you have been paying as your monthly contribution for the last 12 months. SSS Salary Loan .Example of a Loan Calculation: Assume your MSC, based on the SSS table, is PHP 15,000. For a one-month loan: PHP 15,000 (average MSC) x 1 = PHP 15,000. For a two-month loan: PHP 15,000 (average MSC) x 2 = PHP 30,000. These amounts are subject to the member’s actual need and the approval of SSS.the following loanable amounts, but not to exceed the maximum loan limit of P32,000: 3.WHAT ARE THE STEPS IN APPLYING FOR A LOAN? A. The pensioner-borrower must go personally to any SSS branch or service office and present the original and submit a photocopy of any of the following: • Social Security (SS) ID cardLOANABLE AMOUNT The loan amount that may be availed is based on the basic monthly pension (BMP) together with the PI ,000.00 (1 K) additional benefit. Dependent's pension, if any, is not included. The retiree-pensioner has the option to choose the loanable amount from any of the following, but not to exceed the maximum loan limit of P200,000.00.

The member may borrow a one-month or two-month salary loan. Here is a guide on the SSS Salary Loan loanable amounts 2024 based on the total contributions posted by the member-borrower: For members who have posted at least 36 monthly contributions but not more than 71 monthly contributions, the “one-month salary loan is .The maximum loanable amount is Php 1,000,000.00 or the following conditions; Appraised value of collateral of at least 70% but not to exceed 90%; Borrower’s capacity to pay; and Actual need of the borrower based on the contract to sell/scope of work and bill of materials evaluated by the SSS.The maximum loanable amount for an SSS 2nd salary loan is currently set at PHP 30,000 for a one-month loan and PHP 60,000 for a two-month loan. Repayment Terms and Interest Rate: How to Pay Back Your SSS 2nd Salary Loan. The SSS 2nd salary loan has a repayment term of 24 months or 2 years, starting from the second month after the loan’s . Loanable Amount. The maximum loanable amount under the offer is P1 million. The minimum amount is 70% of the appraised value of the property but not to exceed 90%. Interest Rate. Th SSS Housing Loan interest rate is 9% per annum. According to the SSS, the loans with payment terms of not more than 15 years will bear a fixed .The maximum amount of a first-time loan from SSS is typically around Php 20,000. This may be lower or higher depending on your individual circumstances, so it’s important to check with the SSS before applying. So, this is the end of this article but we want you to recommend more things to learn, for example pag ibig salary loan, pag ibig loan .

The primary business purpose of the Attic Tours Philippines, is to engage in the travel agency business and to provide on a professional fee or commission basis, . SM North EDSA Office G/F The Block, SM CITY NORTH EDSA, SM CITY NORTH EDSA Complex, Quezon City Telephone: +63 8372-3254, +63 8373-2594, +63917-898-0905

maximum loanable amount in sss|Guide on How to Apply for SSS Salary Loan